In the business, we joke about PR math. This is when marketers use real data to create an unreal impression. The beauty of PR math is its supposed ethical soundness. Real numbers don’t lie. Similarly, President Clinton “did not have sexual relations with that woman, Ms. Lewinsky.”

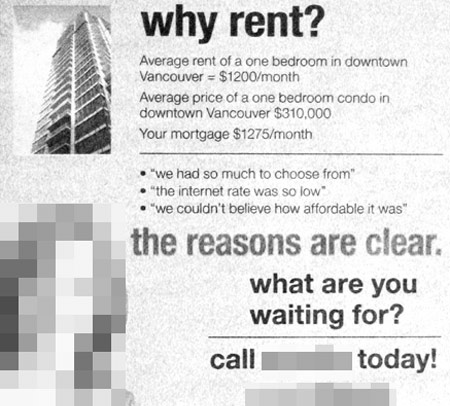

Realtors gladly use PR math. Today’s post shows an example from a westside agent. Because many realtors are running ads like this, I’ve concealed the realtor’s identity so that she’s not unduly singled out. The ad asks “why rent?” and compares rental prices to mortgage payments for an average downtown condo.

I threw the numbers over to Mohican at Housing Analysis, who kindly responded that they are correct. But there’s a caveat and it’s a biggie: You have to factor out taxes and strata fees and have interest rates remain at record lows. Here’s the word:

Thirty-five years amortization is the short answer. One-year mortgages are now at 3.5 per cent and a payment of $1,275 can get on the hook for a cool $310,000. Sounds like a bad idea to me but what do I know, I’m only a financial planner.

I rent downtown, at a place assessed around $300,000, and my rent is very close to the realtor’s example. But my landlord pays the strata, taxes and insurance out of my rent. It’s probably $500 a month. The ad does not mention these costs and for good reason. It’s bad PR math! Own for the price of rent plus 40 per cent or more. Yikes.

March 5, 2009 at 12:22 am

Don’t forget maintenance and… dum de dum dum… special assessments.

March 5, 2009 at 12:34 am

My wife and I have a one-bed rental apartment in downtown Vancouver a block from the park that rents for $300/month less than the average. When we factor in all the other “fees” associated with ownership, we’re paying 50 cents on the dollar. Why would we want to own?

It really is too bad that people are just “too busy” these days to check the PR math.

March 5, 2009 at 12:39 am

The truly sad aspect of your commentary is the number of consumers who fail to consider this when they do their math.

March 5, 2009 at 12:45 am

Saw an example of this fuzzy math over at Youtube. Not to single out the agent, but I had to leave a contradictory comment.

March 5, 2009 at 12:51 am

The only ‘PR math’ I know of leaves me $400/month short of covering my expenses.

March 5, 2009 at 5:51 am

I’m currently renting an apartment in a brand new tower in Toronto. The quality of construction is simply appalling. Baseboards are already peeling away from the walls because of condensation, the (engineered) hardwood is lifting in places, and overall it feels like it’s been designed first and foremost to look good for about six months, rather than to last for 50 years.

Patrioz’s point about special assessments is a really good one. Within five years at the most I predict the owners of units in this building will be paying through the nose for the developer’s incompetence and cost-cutting. For that reason you can probably add an average of $100 a month to the costs of owning.

I simply don’t know who would buy in a new tower. There is just too much incentive for the developer to cut corners.

March 5, 2009 at 8:20 am

Like patriotz mentioned, they were nice enough to leave out maintenence, as well as property Tax. Those together will easily tack on another $300 / month.

Not to mention the fact that when you own it’s not as easy to up and leave if your neighbors are a bunch of crack heads or bar stars. Having horrible neighbors is something you cannot avoid living in a tower downtown.

March 5, 2009 at 9:29 am

Watch out for those low INTERNET rates…. they aren’t the same as low mortgage rates. Although the actual cost of a Shaw internet connection might seem like you actually need a mortgage to afford it in these turbulent economic times.

March 5, 2009 at 10:25 am

Don’t worry about ads like these. They’ll likely cost the realtor up to $100 (or more if they took out more than 1/8 page) and net no new clients. Why? Because it sells the idea of buying and not the idea of contacting that specific realtor. Additionally we all newspaper real estate ads don’t do anything except reinforce the presence of the advertising realtor and are required to be there every week to be effective.

A viewer of this ad who is a renter is likely to think: $1200? OK. I pay around that much. $310,000? Really? Let’s go see… and then they’re on the MLS or another realtor’s site which provide superior search tools (ahem, mine) and IF they find one comparable I’d bet dollars to donuts (who says that? did I just say that?) they contact another realtor. Then they’d find out the math is less taxes and strata fees and on a 0 down and that won’t fly today. Certainly not at 3.5%. So they need about $15k… which they likely do not have unless this was a planned investment which was in something secure and not in the stock market.

Here’s fuzzy math for you: Spend $100 to place an ad that potentially 30,000+ people may see. That’s only $.0033/eyeball!

More likely reality is that: 99% aren’t interested. Of the 1% that are (300 people) 240 can’t do it, 54 will have their interest piqued then go talk to someone else, and 6 might muster the courage to call you only to find that they don’t qualify. Course the aim is to get at least 1 person through. Then the ROI is terrific. But the odds of that happening are against the realtor.

The good news is that we are getting closer to a parity (compared to where we were a few months ago)! Still have a ways to go, though.

-JW what’s wrong with Shaw’s rates? I’m on Shaw and pay $35/mo. Never change, never a problem. Not sure what you mean by actual cost.

March 5, 2009 at 11:29 am

Pretty basic example of advertising here, the idea is to create some excitement for those who are currently renting but have a dream of owning. In my opinion its no different than watching a McDicks commercial and seeing the Big Mac on TV. After watching the ad you rush into a Rotten Ronnies only to be unsatisfied once you actually see the burger.

Also the strata fees and property taxes are a good point. The buyer should already be aware of this. If they aren’t they really shouldn’t be in the market.

Secondly, once the buyer is sucked in to this ad what is the first thing they will do? They will head to their bank to obtain financing as it will be one of the subjects on the deal (pretty standard, especially nowadays). They bank will factor in the strata fees, property taxes, and even heat into the buyers borrowing power.

Bottom line is that I’d say 60-70% of people see this and know the true cost of owning a condo and therefore don’t bite on the ad. The rest of the population (40-30%) will see this and jump at it, and this is who the ad is targeted at. The agent will probably get some good leads out of this, although most of them will dry up once the true cost comes out.

Last point, ads like this dominate the market place today. Open any newspaper and look at some ‘Flight Specials’. Upon first glance there are some spectacular deals, but after careful review the true cost of the flight comes to light. Most people know this already, I’d even say 90% of the people are aware of this, however there is still 10% of the population that bite at those ads, and that is who they are aimed at.

Just my two cents.

March 5, 2009 at 12:07 pm

Here’s some more magic math in a current front page headline:

Housing Sales Double From a Month Earlier

Real Estate Weekly Vancouver East ed. Vol. 30 No. 9 (Friday, March 6, 2009)

March 5, 2009 at 12:14 pm

lol, internet rates. nice typo

March 5, 2009 at 1:41 pm

Here’s some more magic math in a current front page headline:

Housing Sales Double From a Month Earlier

Real Estate Weekly Vancouver East ed. Vol. 30 No. 9 (Friday, March 6, 2009)

I believe that headline. Especially since it shoudn’t be/wasn’t very hard to double January 2009 sales, they were more or less zero.

March 5, 2009 at 3:58 pm

You can’t more or less double zero 😉

0*0 (sales)=a 3% increase in the benchmark for 2009!!!!*

*NOT investment advice of course….

March 5, 2009 at 6:04 pm

Not to mention the fact that when you own it’s not as easy to up and leave if your neighbors are a bunch of crack heads or bar stars. Having horrible neighbors is something you cannot avoid living in a tower downtown.

http://twitpic.com/1biwa

ditto for the ‘burbs

March 5, 2009 at 8:31 pm

The special assesments will kill you. A friend of mine just got hit with one for 50K. Ouch!

Right now there is nothing that makes sense in the Vancouver market. So, live like the Germans. Just rent and take 6 week vacations. Life is good!

March 5, 2009 at 10:36 pm

Special assessments is one thing but also as the building ages the rent it commands decreases. Back of the envelope calculations need to show a MASSIVE contribution or you’ll inevitably be nickeled and dimed into the red. Here their back of the envelope calc barely nets zero.

Danger, Will Robinson, danger!

March 6, 2009 at 12:22 pm

Thank you thank you thank you. I’ve been defending myself for renting for years to people who just don’t do the math!

“Why are you renting? You’re throwing money away!”

Then I show them the math only to watch their brows furrow in disbelief. People really need to look at home purchases as a significant investment and think through the financial implications of their decisions.

March 6, 2009 at 12:46 pm

Absolutely agree that the math is umm, let’s call it “skewed”. but if you rent for the period of a mortgage you just walk away. if you purchase now and sell in 25/35 yearsyou actually get money in your pocket and probably a good deal more than what you forked out to purchase the thing in the first place. Anybody remember discounting or amortization in math class. run those numbers and see what your value is. I can tell you now that the future Value column for the rental math is Zero.

March 6, 2009 at 12:59 pm

Ok, I couldn’t help myself. I had to do the math.

$300,000 condo appreciating at a very reasonable 3% per annum compounded monthly will sell at $635,000 in 25 years time (the end of the mortgage term). the “profit” being $335,000. divide that by the 300 months and you get $1,120 per month.

You are using a rent of $1,200 per month, let’s use a measly appreciation on rent of 3% (your landlord can increase by about 4%, but lets just say he’s a really really nice guy) you will have spent about $525,000 in rent by the end of 25 years. and average of $1,750 per month. hmmm, that looks like about $1200 plus “more than 40%” isnt that interesting. Sure the strata fees etc will go up but that is only a portion of the payment, so lets call the monthly payments on the two sides a wash.

I dont really feel like doing the rest of the math. but essentially you can see where this is going.

you guys should do all the math. I agree the realtors selectively leave out some things, but so did everyone in these comments. “Sales Value” – even with prices dropping as they are, pick one, any one, and look at the price 25 years ago and I guarantee you it has appreciated more than 3% per annum.

much love – Me.

March 6, 2009 at 1:07 pm

Wow, for someone urging people to consider discounting and amortization, you really don’t know your way around the stuff.

March 6, 2009 at 1:08 pm

Ummm Proponent, did you not read the last bunch of comments. The fact that you can rent for almost HALF means that you could put all those savings away in the bank for the next 25 years and earn interest. But it sounds like you’re in the ” why pay someone elses mortgage” camp.

And to me that Math is even more skewed. NO calculations should be based on anything more than 25 years. Anything more than that and you can’t afford the property! These long ammoritization periods for mortgages is what got us into this mess in the first place.

March 6, 2009 at 1:11 pm

So you add in rent increasing but not strata fees increasing? Not to mention that strata fees and taxes and special assessments are not in there. As well as rising taxes and interest rates and the renter never saves a penny even though his costs are half? Sorry dude, you must be an agent with logic like that. Or you bought in the last year and actually feel ill…

March 6, 2009 at 1:15 pm

chris,

i apologize if i made an error. but rather than just saying it’s wrong, feel free to do the accurate calculation. and post that.

March 6, 2009 at 1:19 pm

$300,000 condo appreciating at a very reasonable 3% per annum compounded monthly

Your condo does not appreciate. The purchase price of a new condo the same size as yours goes up 3% per annum. That’s something very different.

Your condo depreciates. At some point in the future it will be worth nothing. Unless you put back the capital into it as it depreciates.

March 6, 2009 at 1:22 pm

DaMann,

i may not have been clear.

The strata fees and taxes are in there (that’s why i made the comment of rent averaging 40% more than the mortgage and therfore being somewhat equal to the total cost of ownership).

I have not taken into accoutn special assessment, you make a good point, however, this assumes you are in a building that is in bad shape or mismanaged. if the contingency fund is sufficient and the budget is set out correctly, then special assessements should not occur often.

I was using the example put forward as accurate by CH, not the examples where people have managed to find a great deal. I have a number of friends struggling to find a place to rent for anything under $1100 in downtown.

I used a 25 year amortization which is standard, not more. I absolutely agree that longer amortization periods are trouble.

I also did say at the end that i stopped doing all the calcs, feel free to fill in the blanks. but unless my calculator is broken, the numbers (based on the figures i put forward) are correct. if you dont agree with the appreciation, or you think your rent will not go up by 3% or more feel free to say so, but i would have serious doubts that that would be the case.

March 6, 2009 at 1:26 pm

[…] Moment! You Control Your FutureI just read an article from the CondoHype blog that ended in a lightbulb flicking on in my head. It is extremely easy to make a significant […]

March 6, 2009 at 1:27 pm

dear patriotz. when i say appreciate i mean that i could sell it at that amount at the end. feel free to find me a 25 year old condo that is cheaper now than it was 25 years ago, even with no capital put back in and I will by you a bottle of wine. And I am specifically talking about downtown vancouver. so don’t try be tricky and pull examples from terrace, BC! hehe. (Wine budget is $30 at BCL) 🙂

March 6, 2009 at 1:37 pm

Proponent

The reversion to your 3% annual appreciation is well under way. -ve 14% YOY to Feb 09′ … how many more years until the +15% per year for the last 5 years is corrected …

As for the math – I think all us “poor renters” are bored explaining it. It’s anywhere between 50-60% on the dollar cheaper to rent right now. Please look at “rennie ticket king comments” in the previous blog.

Good luck

March 6, 2009 at 1:42 pm

Our numbers (rent $1300 and LL’s purchase price 309K) are very similar to the number in that realtor’s ad. Just for fun, the wife and I try to save the real difference between renting and the LL’s monthly outlay. (I opened his mail once. shhhh)

We’re on target to nearly max out our TFSAs ($9600) each year we stay here.

March 6, 2009 at 2:00 pm

dear patriotz. when i say appreciate i mean that i could sell it at that amount at the end.

And you’re wrong. Because a 25 year old condo that has not had the physical deterioration, i.e. depreciation, recapitalized is worth SFA. I am referring to both the condo and the condo’s share of the common property of course.

You are not accounting for the extra capital that has to be invested to compensate for that deprecation, to keep it in the same condition as a new condo, which you are using as a price benchmark.

March 6, 2009 at 3:04 pm

I think one thing that constantly twisted to sound good is “interest rates are at historic lows!” This implies that they will go up. A rate of 0.5 isn’t sustainable long term unless deflation occurs.

If interest rates go up by say a concervative 1% in 5 years this payment becomes ~1500 (+225) the monthly payment :S

Now the *real* bank interest rate has actually been 2.5% so ask yourself if you can afford +2.5% or 1837/mo.

March 6, 2009 at 3:05 pm

er…. “bank interest rate in real terms”

March 6, 2009 at 3:15 pm

[…] This picture comes from Vancouver blog Condohype. […]

March 6, 2009 at 5:44 pm

Real estate salespersons math = figures don’t lie and liars can’t figure. Honk honk!!

March 6, 2009 at 7:14 pm

Can someone explain to me how the mortgage industry in Canada works? Because a $310K place in the US will easily be around $2K a month for a 30 year fixed.

I don’t quite follow the whole 1 year deal.

March 6, 2009 at 7:34 pm

Noz, thats the point of the discussion, trickery pokery with Real Estate Ad math. It’s been designed to confuse. I am not sure but this ad-math is probably an ‘intrest only’ one year teaser. That scam works the same on either side of the border.

March 6, 2009 at 11:05 pm

Proponent, you’re choosing an interesting method of calculating return. patriotz’s point is valid: you need to include depreciation and lost utility in your calcs but they are sooooo easy to forgo in the name of short term profitability. Pay now or pay later.

If the investment doesn’t produce a decent return today there is very little to suggest it will produce a decent return in the future. Things are not as they were. For the sake of your own financial health I recommend you at least consider other arguments posted here. I get the sense you’re arguing for your own benefit but if you’re playing devil’s advocate… as you were.

March 7, 2009 at 5:40 am

Proponent:

Excuse me while I butt in.

You appear to argue that condo (or house) prices naturally increase as if it was some sort of law of nature. The problem with long-lasting bubbles is that many people come to believe that they are the normal case.

This is a well-known fallacy, even if it is pervasive in Vancouver. Prices only increase when the relative desirability of the property increases. For example, Vancouver prices have been increasing over the last 25 years because Vancouver has become more desirable. To continue to increase, Vancouver needs to continue to increase its desirability. Even in the relatively new North American market, housing appreciates more slowly than the DOW, which has an average CPI-adjusted appreciation of 1.64% since the ’20s.:

http://tinyurl.com/ch5brq

This seems difficult since we all know it’s ‘the best place on earth’… . There *must* be a plateau that we will eventually reach.

Here are two interesting references:

1) Long-term price increase: over 350 years, real price doubled in the Amsterdam (academic article)

“A Long Run House Price Index: The Herengracht Index, 1628–1973

Piet M.A. Eichholtz*

*Maastricht University and University of Amsterdam, Amsterdam, the Netherlands

Copyright American Real Estate and Urban Economics Association

ABSTRACT

This article introduces a biennial historic index of real estate values for the period 1628 through 1973. This index is based on the transactions of the buildings on the Herengracht, one of the canals in Amsterdam. Since its development, the quality of the buildings on this canal has been on a constant, high level, which makes the Herengracht a unique sample to base a long run house price index upon. The index is a hedonic repeated-measures index and is estimated in real terms. An index is also constructed in nominal terms. The average real price increase after World War II is about 3.2% per annum. Nevertheless, the real value of the index in 1973 is only twice as high as it was in 1628.”

2) Wikipedia: The tulip mania of 1630 – remind you of anything?

http://en.wikipedia.org/wiki/Tulip_mania

“Tulip mania or tulipomania (Dutch names include tulpenmanie, tulpomanie, tulpenwoede, tulpengekte, and bollengekte) was a period in the Dutch Golden Age during which contract prices for bulbs of the newly-introduced tulip reached extraordinarily high levels and then suddenly collapsed.[2] At the peak of tulip mania in February 1637, tulip contracts sold for more than 10 times the annual income of a skilled craftsman. It is generally considered the first recorded speculative bubble.[3] The term “tulip mania” is often used metaphorically to refer to any large economic bubble.[4]”

3) Read the fable “The Eagle and The Mole” by Krylov and interpret it in the context of the current global housing and equities crash.

It’s about a lordly eagle ignoring a mole’s warnings about the state of the roots of the beautiful tree on which it is building its nest. Moral of the story: if you ignore warnings from others, you may pay a heavy price.

Please let me know where I can pick up that bottle of wine… 😉

mfp

March 7, 2009 at 10:07 am

Well……I rent a $600K condo in Calgary for $1,650 a month.

It would cost $4,500 a month to buy “all in”. Plus the lost opportunity cost on a $100K dowpayment.

We are saving the difference betwene renting and buying each and every month.

I am still waaaaaaay ahead even if my condo went up 3% a year. Which will not happen…….we’ll have two decades of deflation and then a 3 year run of spectacular gains once a new crop of greater fools enters the market……

March 7, 2009 at 11:44 am

dear patriotz. when i say appreciate i mean that i could sell it at that amount at the end. feel free to find me a 25 year old condo that is cheaper now than it was 25 years ago, even with no capital put back in and I will by you a bottle of wine.

I think you’re talking nominal (not-inflation-adjusted) prices, which is where the confusion is coming in. I mean, you might not find a single condo cheaper in nominal terms, but that doesn’t really say anything about the value of real returns, especially compared to other investment vehicles.

March 7, 2009 at 12:20 pm

Proponent

If the rates go up at all in that 25 year period you are done.

300K @ 25years @ 5% = 1744.83

300K @ 25years @ 8% = 2320.65

300K @ 25years @ 11% = 2911.92

And those rates existed in the 1990’s lets not talk about the early eighties.

Vancouver is overpriced just get over it. Buy if you want to buy. I would equate buying in Vancouver to buying a new SUV. You may think it looks great on you but everybody knows you paid too much.

March 7, 2009 at 1:05 pm

If you are one of those people who look at monthly payments over price then it may make sense. But if you are like me and other more logical folk you see the price and it is waaaayyy too much for a shoebox in the sky. Look at more than a monthly payment or you may be in serious trouble.

March 7, 2009 at 1:42 pm

I suspect these ads are put out by realtors and paid, at least partially, by the Real Estate Board. The idea here is 1) to reinforce to people who already bought that buying was the right thing to do; and 2) to continue to put pressure on renters (primarily from owners) that renting is throwing money away.

Its all BS but the more you see it in print the more credibility it gets.

March 7, 2009 at 2:26 pm

Proponent just to add to your lack of experience in the Condo market. I will bet you a bottle of cheap red to find a strata corp(condo) that is 15 years and older than hasn’t seen a special assesment.

The mentality is the same at council meetings and AGM keep my monthly fee down. Well it always leads to assesments later. So, you take your 35 year mortgage and your initial cheap monthly maintenance fees and ride the real estate wave into the reef. Nobody gets it. I managed strata corps for 5 years, what a nightmare. I can’t say I ever heard anyone say WOW what a great investment I made. Usually it was just misery or financial ruin.

March 8, 2009 at 1:10 pm

Hey crew, every year tens of thousands of immigrants come here to fit into the same amount of land. That is why prices go up, value of land. The rest of the numbers are a wash, opportunity cost negated by inflation/fiat money depreciation, etc. Renting is a ticket to poverty in these parts friends.

March 8, 2009 at 2:19 pm

Hey Stu,

Your post is confirmation of how completely succesful the Vancouver condo-selling PR machine is. Many, many people in Vancouver ACTUALLY believe that their apartment is intrinsically a growing asset.

The ‘correction’ is a global phenomenon. Is Vancouver More Special Than Other Places? Why? More special than Toronto, London, Amsterdam, Paris, LA, NYC, Madrid, Moscow, Kiev, Frankfurt, Tokyo, HongKong, Shanghai, Miami, and Dubai?

emmm… no.

So why is it that in all those other (apparently less appealing) cities, economists are talking about a decade before values come back to 2008 levels at the earilest, yet in Vancouver we’re talking about ‘not this summer, but this fall for sure’…

This is plainly delusional.

Check out this foreclosure ad on Craigslist for 888 beach http://vancouver.en.craigslist.ca/reb/1064599528.html being

This poor owner’s trying to sell this place for 800K and it hasn’t sold FOR A YEAR and is now in foreclosure. At that price, he hasn’t got a chance.

There are 60 active foreclosure ads on Craigslist right now for Vancouver. And there are 20 ‘avoid foreclosure’ ads. And that’s telling…

In plain English, condos and houses are available for rent at 1/3 to 1/2 the carrying costs of the mortgage, and property values are lining up to fall another 25% this year… So I can live in a house on Clark and 70th or on the waterfront in a place with a concierge, a pool, and a view.

So by paying $24k of annual rent, a renter will save herself a devaluation loss of around $200K on the apartment they would buy plus the $72K-24K = $58K of mortgage payments plus the $5K of condo fees plus the $3K of taxes plus the $20K of special assessment risk. Let’s not forget that the buyer will also need to have set aside enough down payment to cover the devaluation in order not to lose the mortgage.

In other words: $25K next year gets a fantastic rental, or $283K spent owning the same condo.

mfp

March 8, 2009 at 4:17 pm

Stu

Condo and land hmmm. As the old lady in the Wendy’s Ad said “Where’s the ………land?

You own a box in the sky. Dude. You should checkout Hong Kong or Tokyo or anything of that magnitude. You can always build up. Airspace is unlimited. Knock a 3 storey down and put up 15.

March 8, 2009 at 6:18 pm

Dear MFP,

Thanks for the examples, i appreciate you looking them up. My “wine bet” did specifically say prices in Downtown Vancouver. I don’t know if i missed it, but i don’t think there was an example of a vancouver condo that went down in price.

I also appreciate everyone’s arguments and we can speculate as much as we want about what the prices are going to do in the future. I am playing devil’s advocate to some degree, but i also do believe that in most cases, in the long term you will be better off than renting. For the person who gave the Calgary example, you are absolutely right. given the numbers you are showing, it would absolutely make no sense to purchase that condo.

Anyway, no matter. We all have our own views. if you prefer to rent you should. I prefer to buy, and I will keep doing it. I wont be popping back to this thread so if you do manage to find that Vancouver Condo that is cheaper today than it was 25 years ago, please contact CH directly, they know how to get in touch with me personally.

(Sorry CH, but i just prefer not to throw my personal contact info around the web in such matters, hope you’re ok with that!).

P

March 8, 2009 at 6:58 pm

@Carioca Canuck: I highly doubt the condo you’re renting would sell for $600k. I sold a townhouse condo in Calgary for $650k back in 2007, and my former neighbours have since struggled much more recently to get much more than $500k. There are tons of high-priced condos listed for sale in Calgary, but nothing is selling for anything close to the asking price. A little further West I know a developer in Canmore who hasn’t sold a single unit to anyone except his own staff and family in over a year, out of an inventory of over 100.

More likely you’re renting a $450k condo, soon to be a $350k condo when Calgary prices settle back to the realistic values they had in 2005 or so (when I purchased mine for $375k…). Even then you’re still better off renting than buying, but let’s not get caught up in the hype when making these comparisons.

March 8, 2009 at 9:12 pm

Proponent: Devil’s advocate or not, I appreciate your contribution immensely. This is a blog about ideas. We all benefit from the discussion. My philosophy is to always challenge my own thinking and consider other points of view.

No prob about the contact info. I’ll gladly play wine distributor should it come to that.

March 9, 2009 at 9:16 am

DG……..

I was using the tax departmenty’s assesment value of the condo in my comparison. FWIW the comparables on my street by the river are all between $475K – $1MM……..

March 9, 2009 at 10:17 am

DG………

The city’s tax assessment last year was $633K……comps on my street are listed for sale from $475K for a unit needing a full interior renovation, up to $1MM for current builds. The majority are between $575-750K asking.

Regardless though…….at $1,650 for rent, the unit I live in would have to sel for $200K to make sense for me to buy it. If I subtract condo fees of $300-400, utilities of $75, insurance of $75, and finally taxes of $200…….I have enough left over to service a mortgage of about $200K.

March 9, 2009 at 8:11 pm

Here is the math:

end of first year:

400,000 condo put 40,000 down 360,000 mortgage

goes up 10% a year (maybe not now but don’t buy now)

monthly mortgage 1,500 300.00 condo fee 150.00 taxes

1,950.00

equity end of year: 80,000

Rent 1,500.00

save 450 per month x12

equity end of 1st year: 52,000 \(and that is if renter actually saved his/her money and got a 10% return)

the key with home ownership is FORCED Saving and LEVERAGE, that you cannot get with renting. The home owner can perhaps re-mortgage his property and then re-invest the money in investments with the interest tax deductible

March 9, 2009 at 11:58 pm

What makes you think a renter can’t do FORCED savings? Do you have to stick yourself into a $400K pile of debt to FORCE yourself to save?

How about not having any debt and JUST SAVE?

March 10, 2009 at 1:57 am

Bob:

You’re doing your own PR cooking? Didn’t you read the title of this article? This thread is about applying unrealistic assumptions to calculations to cook happy buying-is-best numbers.

In a stable market where housing prices were what they are worth, you would ALMOST be right.

However, in a stable market, property appreciation would be 2% per year and not 10% per year. So don’t base your entire argument on that bubbly fact.

Hence, your equity after 1st year would be 48,000, not 80,000.

Hence after 1 year in a normal market (say, 2012, after things have stopped falling), you will be in the hole 10K after 1 year of ownership.

But let’s investigate your point further:

Your point about FORCED savings is a pretty good one. People are sheep and are better savers when forced to do it.

Your point about LEVERAGING is wrong. LEVERAGING is a volatility multiplier, causing risk to go up disproportionally.

LEVERAGING only works for you when the asset value valuation curve beats the inflation curve. in the next few years, there is a lot of evidence that the LEVERAGING will work AGAINST owners.

Example:

Put your $40K plus $500/month or so in a GIC or equivalent every month and renew expiring GICs systematically. You get guaranteed growth of about 1% to 2% above inflation. In 2008 and 2009, this would be FANTASTIC returns by anybody’s books.

Put your $40K into a $400K mortgage. If the underlying vehicle goes up 10% in a year, you made a handsome unrealized $40K profit. If however the underlying vehicle goes down 10% (and this year it went down further than that), then after 1 year your initial investment is wiped out.

In other words, everybody who ‘invested’ in Vancouver property and put 10% down in the last 3 years is currently at risk of being underwater by the end of the year. If their mortgage comes up while they are underwater, their banks will force an additional cash injection (or foreclose) and they will be wiped out. Luckily, the cots of money is currently low, so people with cash on hand will be able to inject into the property and compensate partially with low interest. The bad news is that after recessions comes inflation, and mortgage rates are predicted to go up significantly in recovery years (say, 2011/2012 through 2015?).

In conclusion, your numbers only work in a bubble economy and only realtors and people up to their necks in debt still believe in the 10% year-on-year increases. Unless you keep your housing costs within the range that financial planners recommend (and nobody in Vancouver can afford to do that yet), using a house as an leveraged investment is a highly volatile risk.

mfp

Hence,

March 10, 2009 at 7:44 am

Uuuhhh Bob……

Wifey and I have mid six figures in the bank thru forced savings.

March 10, 2009 at 9:39 am

I wouldn’t recommend buying now if you think prices are going down. Overall, the Vancouver market would obtain a 10% annual appreciation. Maybe its not worth buying property in Nova Scotia, but Vancouver historically and the future predicts that a 10% return on average would be what you would get.

If you had a choice of renting or buying in West Vancouver 30 years ago which way would have been better?

March 10, 2009 at 9:51 am

I don’t live in Vancouver, I live in Calgary…..and hands down renting in Calgary and saving money would have been better financially by a long shot.

In fact in the last 6 years alone we have saved as much cash, as someone who would have bought earlier, now has in “perceived” equity.

And the biggest difference is that I can get all of my money today without paying 7%.

March 10, 2009 at 7:39 pm

BOB:

The point isn’t what happens 30 years from now. The point is what happens in a few years when I am completely upside down on my loan or bought a house I could have bought $100K less than today.

If you had a choice of renting or buying in West Vancouver a few years from now when prices are 20-30% less which way would have been better?

And besides….AGAIN…what makes you think you can’t save money while renting?

March 14, 2009 at 9:14 pm

one thing that you are missing out in your argument is that a portion of the mortgage (even though more than rent) is going towards paying down your principal. this has to be factored in as your mortgage will gradually decrease over time.

in addition, with interest rates so low right now, if you lock in for five years, essentially, a bigger portion of your mortgage payment (compared to when there were higher interest rates) are now going towards the principal and not the interest.

i am a home owner but have not always been. i purchased near the height of the market but have always wanted to stay in my home long-term. 1 year ago, i got my mortgage and was paying $2600/month at a good interest rate. now, because the variable has gone down and i’ve had my bank re-adjust my mortgage payments, i am paying $1900/month. in addition, with this $1900/month, $900 is going towards principal paydown. this is after 1 year and 3 months of my mortgage.

in addition, i decided to rent it out and have a lease signed for $2950/month over 12 months. my carrying costs are $2350/month (all in including insurance, property tax, strata, contigency) so my positive cashflow is $600/month PLUS the $900/month in principal paydown which i can access through a secured LOC. what’s great is that i could have easily got $3150/month in rental income, but decided to get a renter in sooner.

when calculating if these renters purchased my property, at a competitve mortgage rate, their costs all in including mortgage, strata etc would be roughly $2450 … approximately $500 less than what they are paying me in rent.

yes, housing values have plummeted across the lower mainland, but over time, they will recover. if you treat your home as a home, then don’t worry about housing prices now. if you look at trends, it is always a cycle and this downturn will eventually turn into an upswing again.

although i agree with condohype on a few occasions, unfortunately comparing rent to mortgage rates is not a good or fair way to treat this argument.

one can also argue that if you have a HomeLine Plan or secured LOC with your mortgage, as you pay down your principal, you will have that cap space added automatically to your LOC. with that money, you can use it as a buffer in case you need it or get fired .. or you can be smart, and invest in another property with interest rates so low. borrowing $100,000 is roughly $208 per month only. and if this is used towards any type of investment, it is a tax write-off against your income.

March 14, 2009 at 9:26 pm

Also, I did some calculations based on real numbers and came to this conclusion:

If you purchased right now at today’s interest rates (let’s say 3.3% variable over 5 years) … you would be in the SAME position …

If you decided to wait 1 year (in which you would rent at roughly $1000 for 1 bed, $1750 for 2 bed or $2500 for 3 bed) and buy the same property at 10% lower purchase price (i.e. 90% of today’s value) and interest rates are 2% higher (at 5.3%).

So again, if you purchase a $1,000,000 property now at 3.3%, you’re in the SAME position as buying a $900,000 property at 5.3%.

People tend to forget the importance of multiple factors in determining whether or not to buy … or to wait it out.

I am not saying that interest rates will go up 2% in one year (they should stay stable at least until early 2010), but it is a possibility … as banks are offering prime+ mortgage now ranger than prime-.

Also of note to people who are new to mortgages, don’t make the assumption that 35 year amortizations are bad. If you do your own calculations, the difference between a 25 year and 35 year amortization can mean a lot in terms of monthly mortgage payments. On a $800k mortgage, the difference is more than $700/month.

However, if you do the numbers, you will find that a huge part of that (like $690/month) was going towards your principal. Only $10 goes to interest. Therefore, don’t assume that with a 35 year amortization, you are paying more interest .. you don’t .. you pay less principal.

PLUS, if you decided to do 35 year amortization, you are actually better off than 25 year amortization, if you exercise the lump sum payment of $8400 at the beginning of each year for the first 5 years of your mortgage (that is $700/month difference between 25 and 35 year amort over 12 months) … you actually pay MORE of your principal down. YES, you are BETTER off doing a combo of lump sum + 35 year amortization than choosing a 25 year amortization.

AND the best part of it is that you would have paid EXACTLY the same amount in mortgage payments through both scenarios.

Just do the math yourself, rather than listening to people who make assumptions. ING direct has a great mortgage calculator that you can play around with.

April 6, 2009 at 6:25 am

Man, alot of dunce people here.

Bob: Leverage also means HUGE Losses.

Proponent: How’s this sound to you…. 30 year mortgage, after 5 years, you’ve only paid off ~10% of your mortgage. 90% interest. + taxes, utilities, you can guess what is heck of a lot cheaper.

May 9, 2009 at 7:58 am

[…] This picture comes from Vancouver blog Condohype. […]